The Stock Market Has Done Well in the Past, But May Not in the Future

The stock market has seen a stellar move to the upside. U.S. stocks are now officially in the longest-running bull market ever on record. Be very careful.

To give you some perspective on the returns, the S&P 500 has soared 330% since the lows in 2009, the Dow Jones Industrial Average has skyrocketed 297%, and the Nasdaq Composite Index has jumped over 500%.

Given the returns on the stock market since 2009, would you say the bull market will continue?

If you listen to the mainstream media, it will have you convinced that this bull run on the stock market will continue and that there isn’t really much to worry about. You will also see a lot of stories telling you that the Dow could hit 30,000, and that the S&P 500 will see non-stop increases.

If you make a decision based on mainstream opinion, you could be setting your portfolio up for disappointment. There are problems brewing, and almost no one’s talking about them. Let’s look at three worrisome factors that shouldn’t be ignored.

3 Developments Investors Shouldn’t Ignore

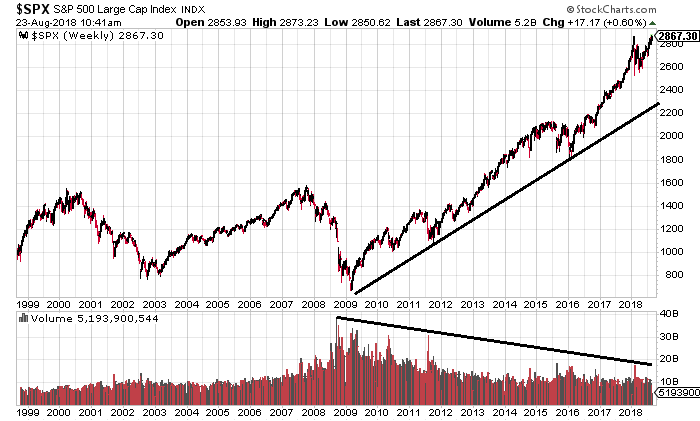

First, volume on the stock market has diminished substantially; the returns have been exponential of sorts.

To get a better idea of what I’m talking about, look at the long-term chart of the S&P 500 below.

Chart courtesy of StockCharts.com

Since 2009, the market has surged, especially the S&P 500, which has stretched really far out from the long-term trend since 2016. But while this has been going on, volume has declined.

For the stock market to go higher, participation is important. The low trading volume could be because stock prices have gone up too high for many investors.

Second, look at the margin debt on the stock market; this is the money borrowed to buy stocks.

Why bother with this figure? Because margin debt could serve to throw more gas on the fire. If a sell-off happens, people who have borrowed to buy stocks may be forced to liquidate their positions. This could make selling much more severe.

As of July, margin debt stood at almost $652.8 billion. In July 2010, margin debt was less than $267.5 billion, meaning an increase of 144%. Needless to say, soaring margin debt is concerning. (Source: “Margin Statistics,” Financial Industry Regulatory Authority, last accessed August 23, 2018.)

Lastly, contrarian indicators are saying that it’s time to pull back a little. In the most recent Investor Sentiment Survey by the American Association of Individual Investors (AAII), 73% of all respondents were either bullish or neutral on the stock market while the remaining 27% were bearish. The latter figure is below the historical average of 30.5%. (Source: “AAII Investor Sentiment Survey,” American Association of Individual Investors, last accessed August 23, 2018.)

Stock Market Outlook: Don’t Get Complacent

The bull market has rewarded investors immensely. Sadly, this may not be the situation much longer.

I can’t stress this enough: when you start to hear things like “we are at all-time highs,” or “the longest bull market in history,” the last thing you should do is get complacent.

In the short term, the stock market may move up a bit. However, the long-term outlook is dire. The problems mentioned here are just a few of the many things that make a bearish case for the long term.